Simplifying portfolio analysis for professional investors.

Finominal provides easy-to-use portfolio analysis and research tools that create transparency and actionable insights across markets globally.

Featured in

Who is it for?

Financial advisors

Analyze client portfolios and create custom proposals using stocks, funds, ETFs, or model portfolios. Streamline or fully outsource your investment process for greater efficiency.

Institutional investors

Unlock a deeper understanding of complex multi-asset portfolios, including private market strategies. Save time and reduce costs compared to traditional providers.

Asset managers

Gain valuable insights into your fund’s peers, factor exposures, and risk drivers. Enhance market positioning to attract and grow assets under management.

Why choose Finominal?

Simplified, smarter investing with powerful AI-driven tools that make portfolio management, factor analysis, and investment research effortless.

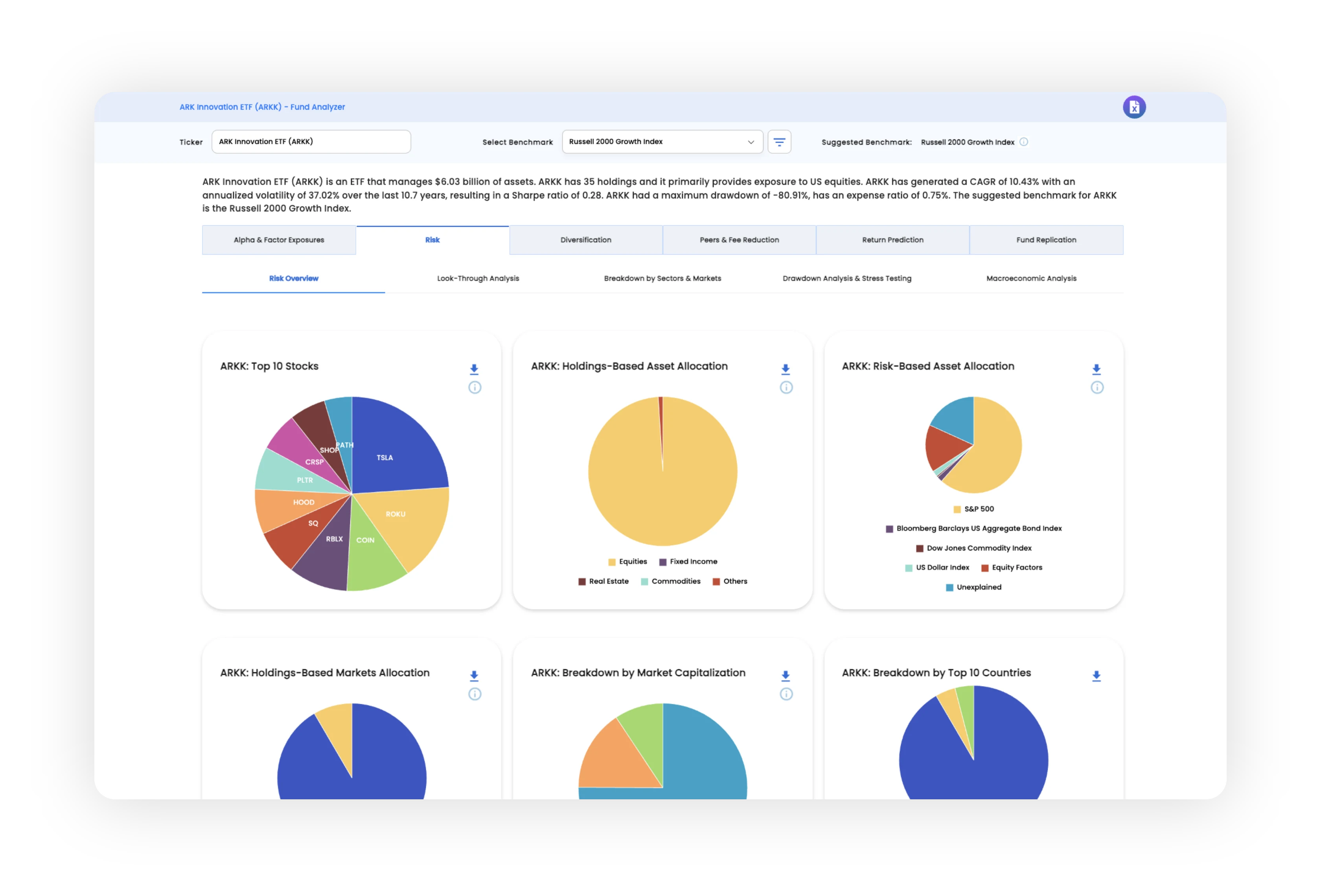

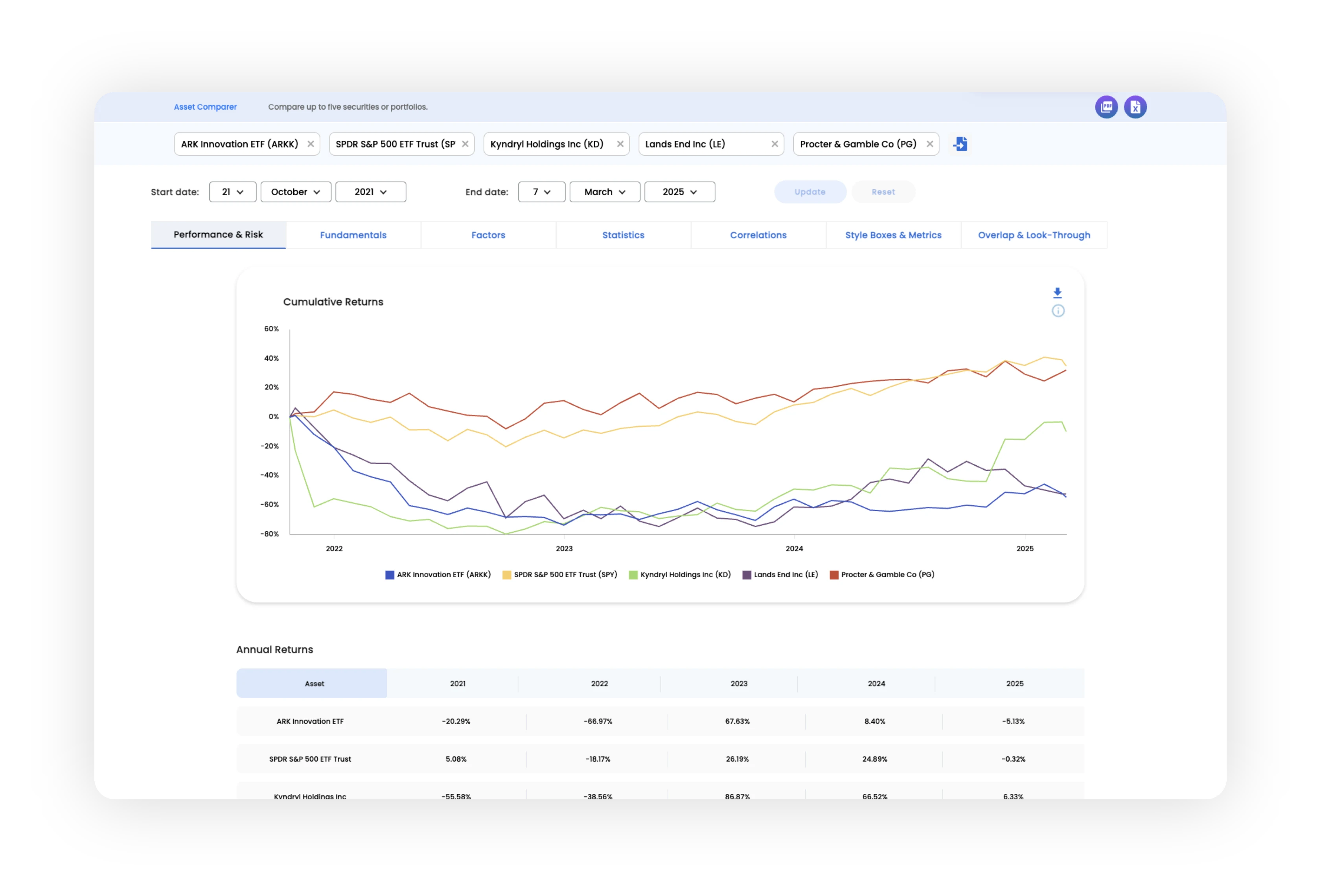

Effortless portfolio analysis

Instantly create, upload, or analyze portfolios using our database of 100,000+ global tradable instruments.

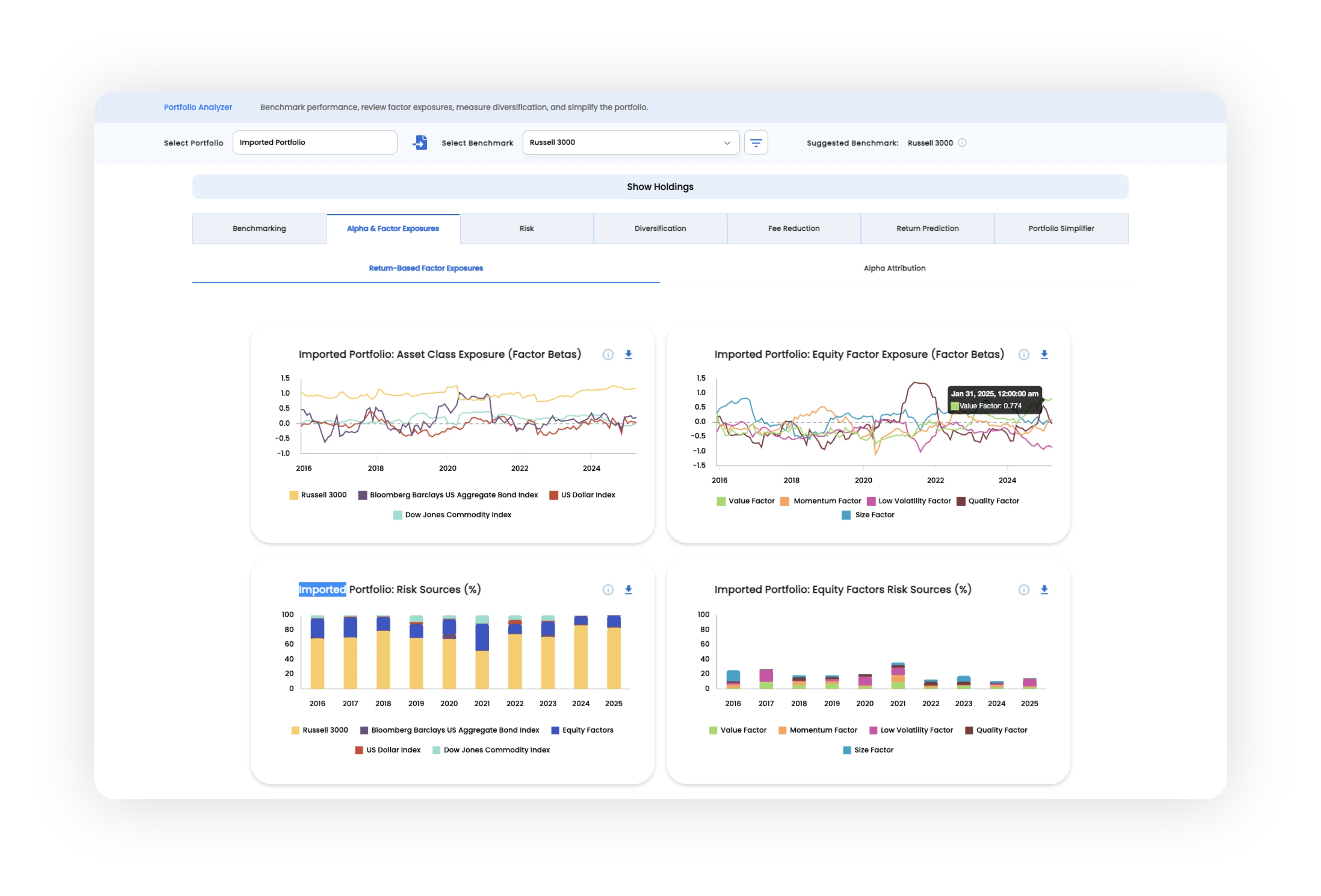

Clearer factor insights

Identify the key drivers of returns and risks with transparent, data-driven analysis.

Simplified, optimized portfolios

Cut through complexity. Our tools help refine portfolios for efficiency and cost savings.

AI-powered investment research

Get instant answers to research questions with our AI-driven assistant using our content library of 400+ expert articles.

Resonating testimonials from our delighted users

ROBIN POWELL

Journalist and Author, and Editor of The Evidence-Based Investor

“Whatever you’re looking for — whether it’s just a second opinion, independent analysis of your performance and expected future returns, or a radical overhaul of your investment strategy — I can highly recommend the services Finominal offers.”

Insights

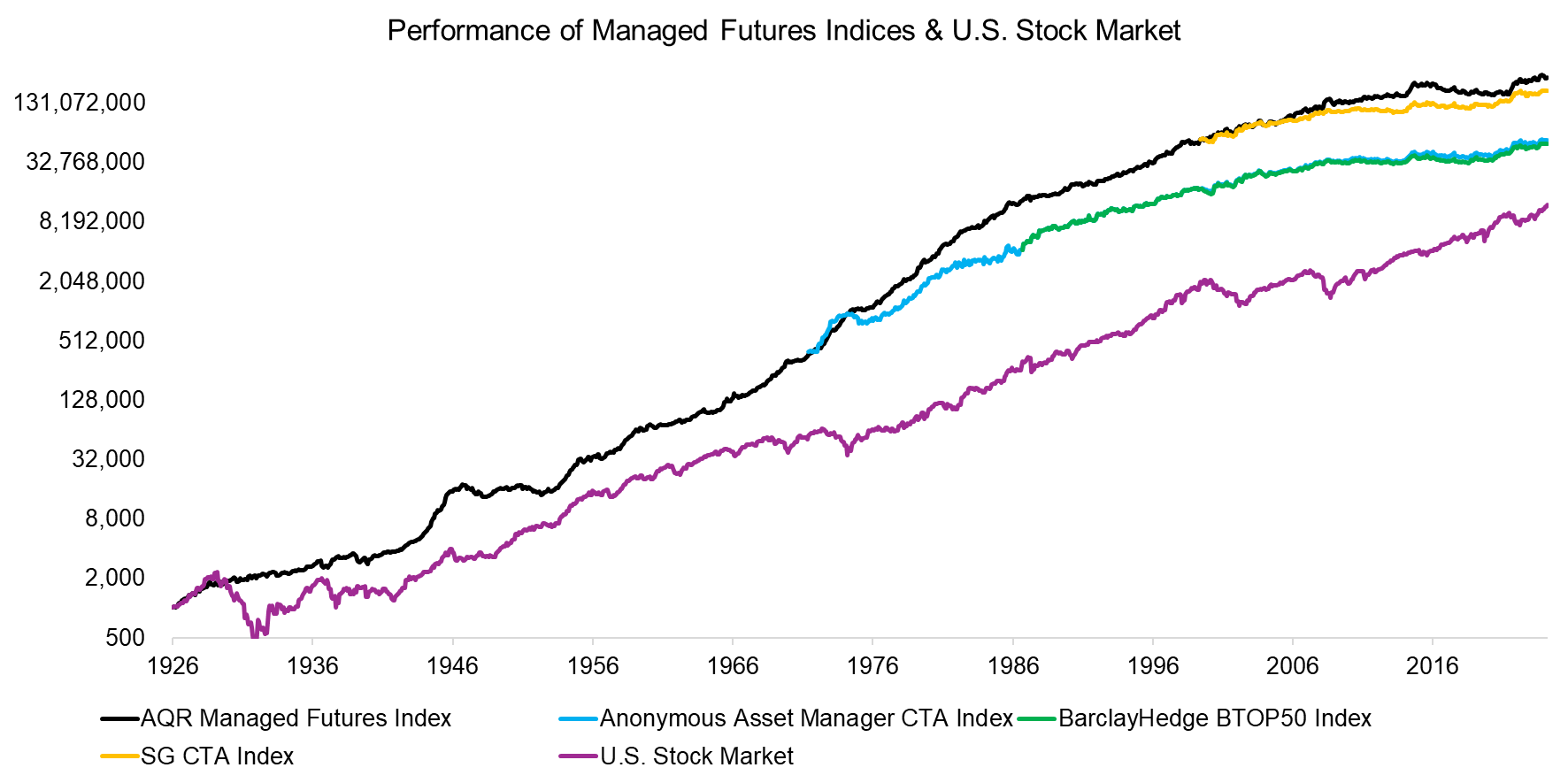

Combining Risk-Managed Equities and Managed Futures – II

Do you need risk management for equities in a diversified portfolio?

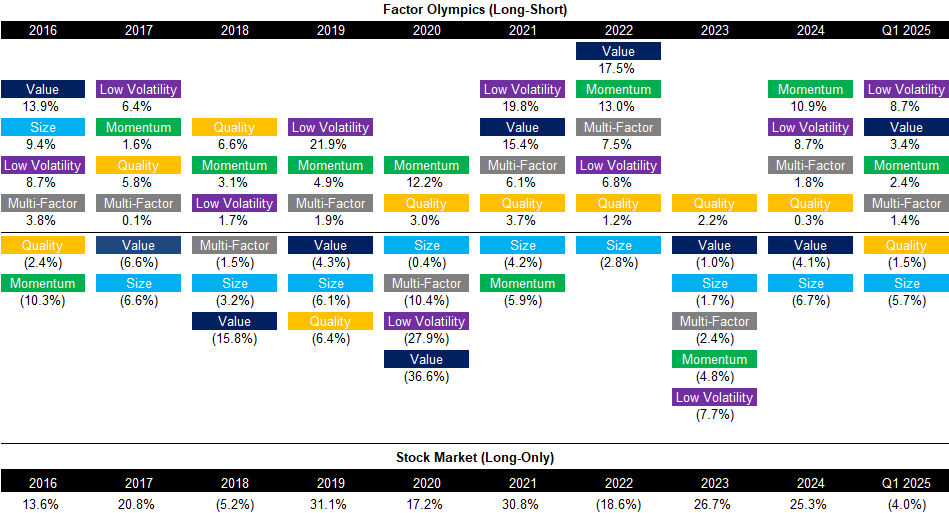

Factor Olympics Q1 2025

And the winner is...

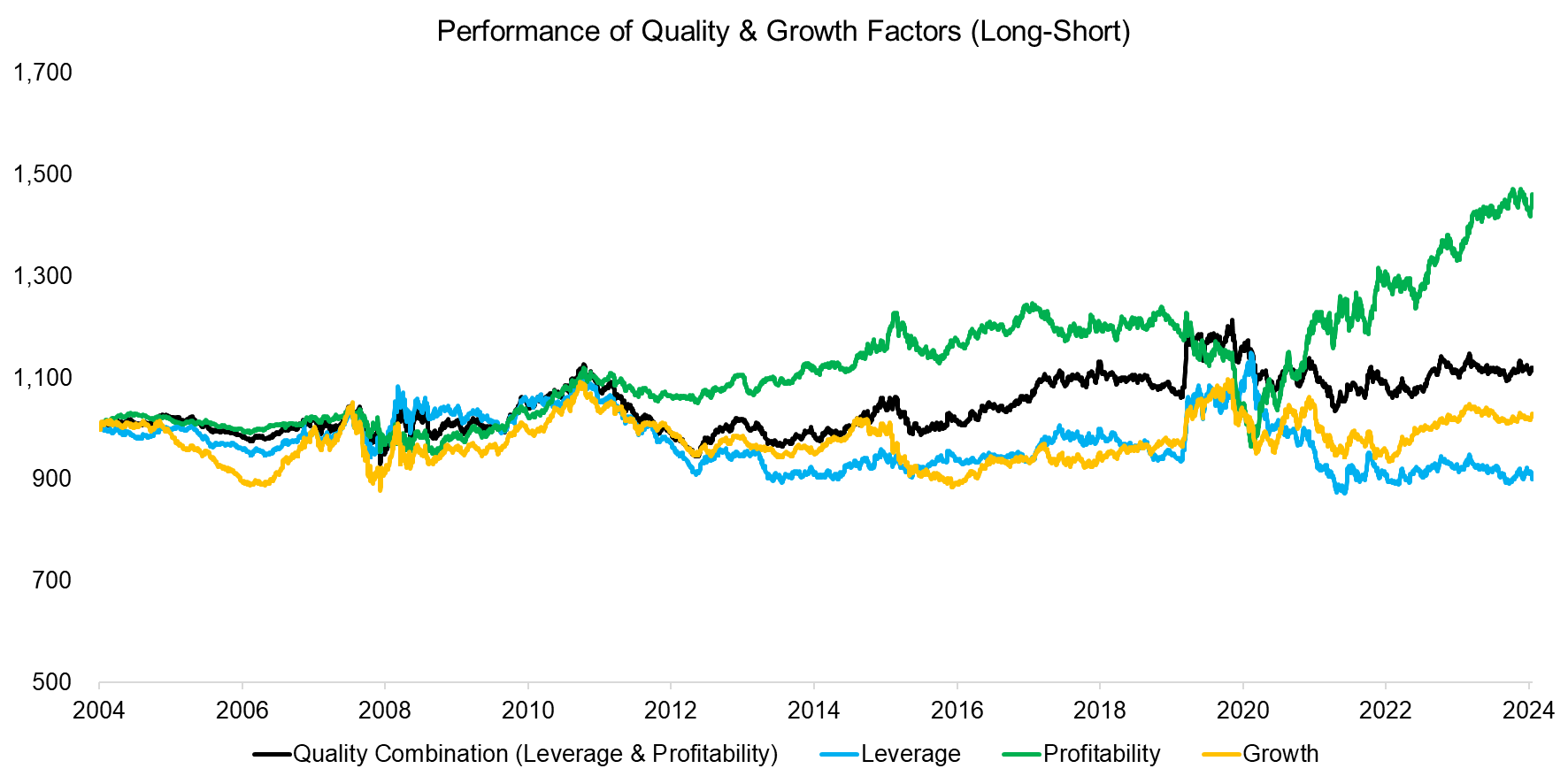

Factor Exposure Analysis 113: Profitability vs Leverage Factors

What quality and growth factors should investors be using in a factor exposure analysis?

Ask our AI Research Assistant

What research question can I help you with?